How To Register A Llc Business In California

Do It Yourself

Sign up for a free account and use our online tools to start your California LLC today. Includes California LLC formation and maintenance walkthrough and company document creation. All for free—just pay state fees.

$ 0 Total

Go Monthly

Skip the state fees! Get a California LLC and the best of our services today. Includes EIN, hassle-free maintenance, business address & mail forwarding, Privacy by Default®, local Corporate Guide® service, and everything you need to operate at full capacity.

$ 34 / Month

Pay in Full

Includes California LLC, business address & free mail forwarding, free 60-day Phone Service trial, Privacy by Default®, lifetime support from local Corporate Guides® and a year of registered agent service.

$ 315 Total

Rated 4.5 / 5 stars by 261 clients on Google

California LLC Client Profile

"The resources Northwest Registered Agent provided—including operating agreement templates—were invaluable. Can't recommend these guys enough."

VidaCher

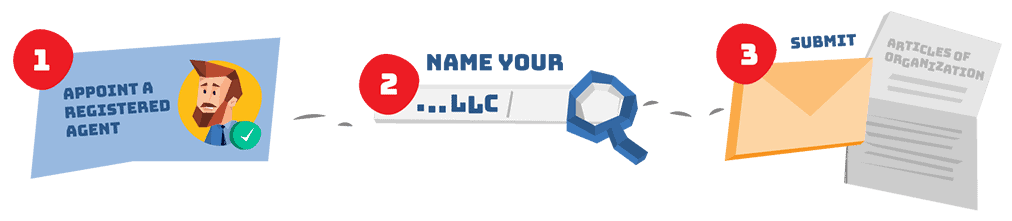

To start an LLC in California, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Organization with the Secretary of State. You can file the document online or by mail. The articles cost $70 to file. Once filed with the state, this document formally creates your California LLC.

1

Appoint a Registered Agent

According to CA Corp Code § 17701.13, every California LLC must appoint and continuously maintain a registered agent (also called an "agent for service of process"). You don't need to hire a registered agent, but if you do, make sure your registered agent will list their address on your articles wherever possible to ensure maximum privacy.

2

Name Your LLC

If you're starting a new business, you probably already know what you want to name your LLC. But you'll need to know if your preferred name is available. To find out, visit the California SOS Business Search and browse until you find the perfect name for your LLC.

3

Submit California Articles of Organization

Once you know who your registered agent will be and what your LLC name is, you're ready to file your California Articles of Organization. Follow along with our filing instructions below:

Learn more about each Articles of Organization requirement below. Note that the information you provide becomes part of the public record—permanently.

Or skip the form entirely and hire us to form your California LLC. We provide a free business address to list whenever possible throughout the filing to better keep your personal address private. And for the cheapest way to start a business? Pay just $34 out the door with our VIP monthly payment option.

1. LLC Name

Include "Limited Liability Company" or an abbreviation in your LLC's name. You can't choose a name already in use, and you can't include any words that suggest you're a bank, insurance company, or corporation. Basically, you're not allowed to name your company anything that could potentially mislead the public. Sure, "Joe's Muscle Insurance Fitness Center LLC" is a sweet name for a gym, and it may seem unlikely that people would attempt to take out insurance policies from confused personal trainers. But you'll have to let that dream go, as California is not having it.

2. Business Address

Your business address doesn't have to be your LLC's office, but it does have to be a street address in California. (There's also a line to include a mailing address if that's different from the street address provided.) Like all the info you put in your articles, the address you list will become part of the public record. Hire Northwest and you can use our address throughout your Articles of Organization.

3. Agent for Service of Process aka Registered Agent

For your California registered agent, you can list an individual state resident (like yourself) or a corporate agent registered with the California Secretary of State (like us). When you list an individual, both a full name and street address are required. Remember that this will all become part of the public record. Don't want your home or office address to be searchable by the public? When you hire Northwest, our address is listed here instead.

4. LLC Management

You have to choose if your LLC will be managed by all its members (like a partnership), by one manager, or by more than one manager. Managers aren't required to be members of the LLC, but it's okay if they are. If you're not interested in running the day-to-day operations of your LLC, it would be better to appoint a manager—however, if you hand over decision-making powers to managers, your remaining powers will be limited.

5. Purpose Statement

You can skip this step. While California has gone to the effort of putting "purpose statement" on the form, they do not want you to go to the effort of writing your own statement. They've provided a purpose statement for you, and you are not allowed to alter it.

6. California LLC Organizer

The word "organizer" throws a lot of people off because it sounds fancier than it is. The organizer is just the person or business signing and submitting your articles. They don't even have to be a member or manager of your LLC. When you hire Northwest to form your LLC, we'll be your organizer, and our information will go here.

Professionals in California hire registered agent services like Northwest Registered Agent to start an LLC—but why?

Logistics

Standard filing companies don't have employees or offices in every state. But as a national registered agent, it's a requirement for us, which is a benefit for our clients. We own our own building in Redding, CA. We're on a first name basis with the people who work in the Secretary of State's office. We know all the fastest filing methods, which translates to fast, professional service—without extra fees.

Privacy

As your registered agent, we list our Redding registered office address on your LLC's formation documents. Why? If you're starting a business from your apartment in Oakland, do you really want your apartment address as your business address? (Hint: the answer is no.) We'll list our address, so you don't have to list yours. Plus, we never sell your data. We don't list your personal information on filings if we don't have to. It's all standard and part of our commitment to Privacy by Default®.

Free Mail Forwarding, Business Address and More

At Northwest, we do everything a registered agent should do and more. You can list our address as your business address on your state filings. We include limited digital mail forwarding with registered agent service (up to 5 pieces of regular mail per year; $15 a doc after that).

Plan on accepting credit cards? We also offer a Free Credit Card Processing Consultation. Our specialists work with processors to negotiate low rates and better contracts for our clients.

And now, try our in-house Northwest Phone Service for 60 days, free of charge with our formation service. Get a virtual phone number with your choice of area code, make and receive calls from any device, and more—for just $9 a month.

Local Expertise

We know the in's and out's of each state—and we use this knowledge to help you when you need it most. Our team of Corporate Guides® has over 200 local business experts. You can call or email us for answers to all your questions about your LLC in California.

After your California Articles of Organization are approved, you still have a few more important steps to take, including getting an EIN, drafting an operating agreement, opening a bank account, funding the LLC and learning about state reporting and tax requirements.

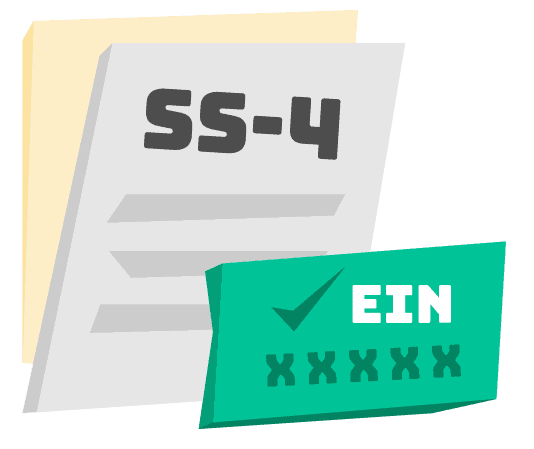

Get an EIN

An EIN ("Employer Identification Number") is a federal tax ID assigned to your business by the IRS. The IRS uses your EIN to easily identify your business on tax filings.

Does a California LLC need an EIN?

Yes—you'll need an EIN to file your Annual LLC Tax payment and LLC fees (if applicable) with the California Franchise Tax Board. You'll also need an EIN if you have employees, and you'll likely use your EIN when you open a business bank account.

How do I get an EIN for my LLC?

You can apply for an EIN directly from the IRS at no cost. Most businesses are able to apply online, but if you don't have a social security number, you'll need to apply with a paper form. Want one less thing to do? Add on EIN service when you hire us, and we'll get your EIN for you. Or choose our VIP service—an EIN is included.

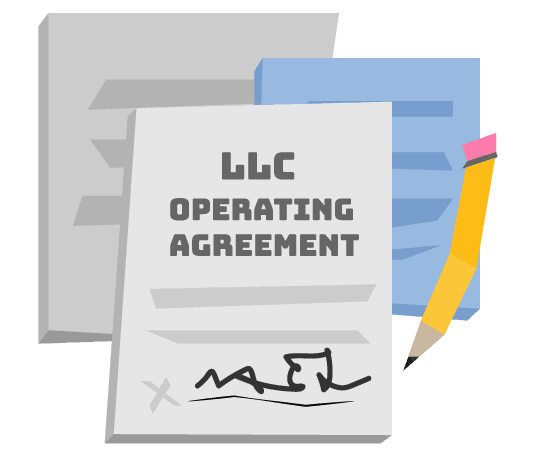

Write an LLC Operating Agreement

Operating agreements put into writing how your business actually operates—how much each member invested, how profits and losses will be allocated, how voting works, and what happens if there's a dispute or if the whole business (knock on wood) falls apart.

For more on California operating agreements (including free California operating agreement templates), see our California LLC Operating Agreement resource.

Do I need an operating agreement for a California LLC?

Yes. While no California government agencies actually need to see your LLC's operating agreement when you form your company, you are required to have one. According to California Corporations Code § 17701.13, a California LLC is required to have an operating agreement and to keep a copy of it (if in writing) maintained in a legible, tangible form. The language of the law is fluid enough to indicate that the operating agreement doesn't technically need to be written down. But why just speak an agreement when you could get it in writing? Oral operating agreements can get messy for all kinds of reasons.

It might seem like an operating agreement is just one more box to check. But, it's actually one of your LLC's most important internal documents. Having one on hand will help your LLC with everything from opening a bank account to handling major events like mergers and dissolution.

What should be in an operating agreement?

An operating agreement should explain how the business will handle "big picture" situations—everything from allocating profits and losses to dissolving the business. Below is a list of common topics that operating agreements should cover.

-

Initial investments

-

Profits, losses, and distributions

-

Voting rights, decision-making powers, and management

-

Transfer of membership interest

-

Dissolving the business

Your operating agreement can cover pretty much anything as long as it isn't contrary to California law. Topics not allowed in the operating agreement are listed in the California Corporations Code § 17701.10, which forbids things like changing an LLC's capacity to sue or be sued, and varying the power of the court.

How do I write an operating agreement?

To write an operating agreement, you need to address how your business will handle money, members, votes, management, and more. Not sure how to get started? At Northwest, we're here to help your LLC get off on the right foot. When you hire us, we provide your business with a free LLC operating agreement, specific to your management style. We've spent years developing these agreements and other free LLC forms—which have been used by over a million LLCs.

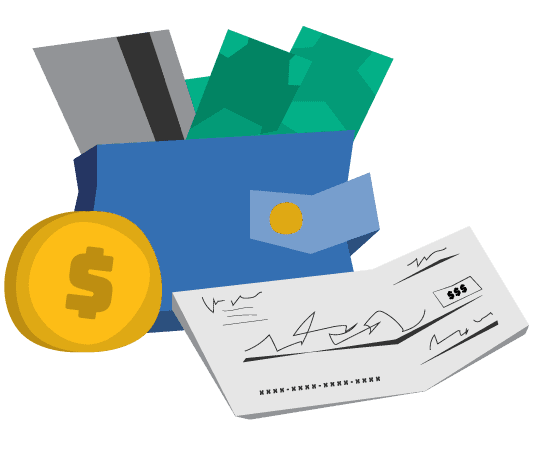

Open an LLC Bank Account

Your LLC needs its own bank account. Why? An LLC gets its limited liability from being a distinct entity, separate from its members. If you mix personal and business finances, you could lose your liability protections.

How do I open a bank account for my California LLC?

To open a bank account for your California LLC, you will need to bring the following with you to the bank:

-

A copy of the California LLC Articles of Organization

-

The LLC operating agreement

-

The LLC's EIN

If there are multiple members in the LLC, you may also want to bring an LLC resolution to open a bank account that states that the person going to the bank is authorized by the members to open the account in the name of the LLC. Northwest can help with this as well—LLC bank resolutions are one of the many free legal forms we provide to ensure you can get your LLC started fast.

Fund the LLC

Time to put some money in that new LLC bank account. What money? For starters, your initial contributions to your LLC's capital. LLC members are owners, and each owner needs to pay for their membership interest to fund the LLC.

What is membership interest?

Membership interest is your percentage of ownership of the LLC. Membership interest is normally proportionate to your investment. So how does this work?

Imagine your LLC has 5 members. 4 members each invest $1,000 in the business. One member invests $6,000. The total contribution of all members is $10,000. The 4 members each own 10% of the business. The moneybags member who shelled out $6,000 owns 60% of the business.

Typically, this also means that the 4 members would each get 10% of any profits, and moneybags would get 60%. Exactly how profits and losses are allocated, however, can be adjusted in the operating agreement as long as changes are in line with IRS requirements and California laws.

File California Reports & Taxes

California LLCs are required to file a Statement of Information every two years, and an initial statement upon the LLC's formation. Both the initial and subsequent statements essentially just let the state know who currently runs things and how to contact your business. California LLCs are also subject to state tax filing requirements.

How much is the California Initial Statement of Information fee?

The fee for the California LLC Initial Statement of Information is $20. We include this filing with our California LLC formation service.

When is the California Initial Statement of Information due?

You California Initial Statement of Information is due 90 days after your LLC's formation. When you hire Northwest, we'll submit your Initial Statement of Information alongside your Articles of Organization.

How much is the California Statement of Information fee?

The fee for the California LLC Statement of Information is $20. The real killer is the late fee. If your report is more than 60 days late, you're stuck with a $250 penalty. If you continue failing to pay and file, your LLC may be dissolved.

When is the California Statement of Information due?

Your California LLC Statement of Information is due on the last day of your LLC's anniversary month every two years.

When you sign up for Northwest, we send you reminders for your biennial statement of information due dates. Want one less thing to worry about? With our business renewal service, we can complete and submit your statement of information for you for $100 plus the state fee.

What is the California LLC Franchise Tax?

The California franchise tax is a tax for the privilege of doing business in California. LLCs typically pay $800 a year—and potentially more depending on how they are taxed. For LLCs taxed as partnerships or disregarded entities, the Annual LLC Tax is a flat $800. For LLCs taxed as corporations, the $800 is a minimum. S corporations pay a 1.5% tax on net income and C corporations pay an 8.84% tax on net income. So, if your tax on net income comes out to less than $800 (i.e. if your net income is less than $53,300 for an S corp or $9,045 for a C corp), you're still stuck paying at least $800. A lot of people try to avoid the California franchise tax, but California has really double-downed on franchise tax regulations, making it nearly impossible to avoid.

This tax is due even if your LLC takes a year off from conducting business. In your LLC's first year of existence, the tax is due on the 15th day of the fourth month from the date you file articles with the Secretary of State. For all other years, the annual tax will be due on the 15th day of the fourth month of your taxable year. So if you file articles in June, your tax is due by September 15th.

The only exception to paying the annual tax is if your LLC's tax year was 15 days or less, and if no business was conducted during that time. Otherwise, the Annual LLC Tax only stops being required if your LLC stops existing (and is properly dissolved). Bummer.

Note: Thanks to California Assembly Bill 85, California LLCs, LPs, and LLPs formed between January 1, 2021 and January 1, 2024 are exempt from paying the California Franchise Tax for their first taxable year in business.

What is the California Annual LLC Fee?

In addition to all the other taxes and fees, high-income LLCs have yet one more fee to pay each year. It's a separate, flat fee—$900, $2,500, $6,000, or $11,790 based on the LLC's income.

$900 fee: $250,000-$499,999

$2,500 fee: $500,000-$$999,999

$6,000 fee: $1,000,000-$4,999,999

$11,790 fee: over $5 million

If you think your LLC will owe the fee, you'll have to make an estimated payment, filing Form FTB 3536 (and if you're wrong and don't pay it or pay too little, you'll not only have to pay the fee but an additional 10% penalty for failing to be a psychic).

What else should I know about California LLC taxes?

California has some of the highest personal net income tax rates in the country. Personal income tax rates in the state are marginal—higher income is taxed at a higher rate. So, if a person makes $40,000, the first $8,809 is taxed at 1%; $8,810-$20,883 is taxed at 2%; $20,884-$32,960 is taxed at 4%; the remainder is taxed at 6%. The personal income tax rate tops out at 13.3% for any income $1 million and over.

The state also has a 7.25% sales and use tax—cities and counties often add on their own sales and use taxes as well. The highest combined state and local sales tax rate in California can be found in Los Angeles County, which tops out in cities like Santa Monica and Burbank at 10.25%.

Sure, California has some high taxes, but it's also bristling with entrepreneurial spirit. (And if you're reading this page, so are you.) At Northwest, we can form your California LLC for as low as $315. Or, pay just $34 out the door with our VIP monthly payment option.

Do LLCs have to register with the California Franchise Tax Board?

Yes. All LLC's are required to pay the $800 California LLC Annual Tax, which is filed with the Franchise Tax Board. You can register for a MyFTB account online.

How can I submit the California LLC Articles of Organization?

You can file California articles online, by mail, or in person. Mailed filings must be sent to the following address:

Secretary of State

Limited Liability Company Filings

P.O. Box 944260

Sacramento, CA 95814

It costs an extra $15 to drop filings off in person. Guaranteed expedite services are only available when you hand-deliver your documents to the Sacramento office of the Secretary of State at 1500 11th Street, Sacramento, CA 95814.

How much does it cost to start a California LLC?

The filing fee for your California LLC Articles of Organization is $70. Add $5 if you want to receive a certified copy of your articles, and $15 if you deliver your articles by hand. If you want to expedite, it gets pricey fast. California charges an additional $350 for 24-hour processing and a whopping $750 to get a response on the same day. (And remember, expedite services are only available when your articles are hand-delivered to the Sacramento office.)

Within 90 days of filing, you must also submit your initial statement of information, which costs $20. When you hire Northwest, we'll submit your initial statement alongside your articles, bringing your state filing fee to $90 total. Hire Northwest for a one-time fee of $315, which includes state filing fees, a year of registered agent service, limited mail forwarding and loads of useful forms and tools to help get your California LLC up and running. Or, pay just $34 out the door with our VIP monthly payment option.

How long does it take to start a California LLC?

It can take anywhere from a few hours to a few days to form your California LLC, depending on how you choose to file. If you file in person at the Sacramento office, you can pay for 1-day or same-day processing. When things are running smoothly, online filings generally take around five business days. If you'd prefer to grow a beard while you wait, you can mail your California Articles of Organization. Expect to wait a few weeks.

If you hire Northwest to start your LLC, we file online and typically have your California LLC formed within five days.

Does a California LLC need a business license?

Yes, California LLCs are required to have a business license—but the state doesn't actually issue licenses itself. Instead, licenses are issued at the local level, so you'll have to apply for a license from the city or county where your LLC is registered. For example, in San Francisco, all businesses within the city limits require licensing, and permits are required before you can operate establishments like swimming pools or billiard halls. In Pasadena, a retail clothes establishment needs a permit if the store has a burglar alarm, and needs a general business license regardless (as do all businesses within the city limits).

Need an EIN or a certified copy of your formation docs for your license applications? Northwest can help. You can easily add on these items to your LLC formation order.

Can a California LLC help me live more privately?

Yes. While you can't remove all ownership information from California public filings (like you can in states like New Mexico, Delaware, and Wyoming), a California LLC can still help you reduce your public footprint. You can maintain a significant degree of address privacy by listing our address on public docs instead of your own. Check out our page on living privately with an LLC to learn more.

What is a foreign California LLC?

A foreign California LLC is any LLC formed outside of California but registered to do business in the state. For example, if you formed an LLC in Oregon but wanted to conduct business in California as well, you would register as a foreign LLC in California by filing an Application to Register a Foreign Limited Liability Company with the California Secretary of State. Like domestic LLCs, foreign LLCs in the state have to file California Statement of Information reports every two years. Northwest can register your foreign California LLC for you today!

How can I get a California phone number for my LLC?

It's a conundrum: you need a local number to display on your website and give to customers, but you don't want to make your personal number quite so…public. We get it. And we've got you covered with Northwest Phone Service. We can provide you with a virtual phone number in any state—plus unlimited call forwarding and tons of easy-to-use features. You can try Phone Service free for 60 days when you hire us to form your LLC, and maintaining service is just $9 monthly after that. No contract required.

Our California LLC formation service is designed to be fast and easy—signing up takes just a couple minutes. Here's how it works:

1

Signup

With Northwest , we give you flexibility on how to pay. You can pay all the fees up front (this includes o ne full year of registered agent service ) . Or, pay just $ 34 out the door with our VIP monthly payment option. With our VIP option, we also include an EIN. Just choose one of the buttons below, answer a few easy questions about your business and s ubmit your payment.

2

State Approval

W e'll prepare your California Articles of Organization and send them to the Secretary of State for approval. In the meantime, you'll have immediate access to your online account, where you can find useful state forms, pre-populated with your business information.

3

Your California LLC!

Once the California Secretary of State has approved your filing, we notify you that your California LLC has been legally formed. You can now take any necessary next steps, like getting an EIN and opening a bank account.

How To Register A Llc Business In California

Source: https://www.northwestregisteredagent.com/llc/california

Posted by: juarezalloss.blogspot.com

0 Response to "How To Register A Llc Business In California"

Post a Comment